Florida Residents Deserve Tax Reform

In a recent editorial by Adam Guillette, former Director of the free-market group Americans for Prosperity, he indicated that ‘The simple fact is that Floridians are being overtaxed. Government is growing at rates that are not sustainable, especially at the local level.’ The basic argument is that local governments throughout Florida had a windfall in excess revenues as a result of the increases in real estate values yet the demand for local services did not grow at the same rates. Local governments moved quickly to spend those excess revenues by increasing their sizes and investing in pet projects of political patrons. Now, with the deflation of real estate values and the projected decreases in revenues, many local municipalities are struggling for ways to cut their excesses. Read the full Article here.

Most local governments do not have a sufficient level of knowledge, responsibility or capacity to handle a sharp downturn in the economy so the end result might be the worst of all: A bear market combined with tax increases. Nothing else could kill prosperity with more efficiency.

For Florida, a taxpayer protection amendment is the best method of smoothing over the business cycle and reign in the irresponsible spending. It would require politicians to get voter approval over any new tax increase, tying the increase of government revenue to inflation and population growth. This would force fiscal responsibility on all levels of government, and creation of a rainy day fund to manage services in the time of revenue decline.

Yesterday, The Florida chapter of Americans for Prosperity urged the Taxation and Budget Reform Commission (TBRC) to approve a constitutional limit on state and local government spending so voters can decide the issue on the ballot. The Finance and Taxation Committee of the TBRC was slated to debate and vote on the government growth cap known as the Taxpayer Protection Amendment. Read Full Text .

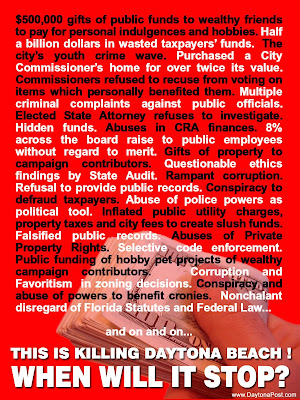

Daytona Beach is one of the most egregious examples of overspending by public officials. The City budget has doubled from $100 million to over $200 million in just five years.  During the same period, Property Taxes have increased by 118% and the number of city employees more than doubled to over 1,100. However, the number of Daytona residents, 64,000, hasn't changed in ten years. This implies that the demand for city services has not grown either and neither has the need for more city employees to provide those city services. The cost of living (consumer price index) has risen 16 % in seven years which means the city budget and spending should have only increased a little over 2% annually or $10 million in five years. Yet, it grew by $100 million.

During the same period, Property Taxes have increased by 118% and the number of city employees more than doubled to over 1,100. However, the number of Daytona residents, 64,000, hasn't changed in ten years. This implies that the demand for city services has not grown either and neither has the need for more city employees to provide those city services. The cost of living (consumer price index) has risen 16 % in seven years which means the city budget and spending should have only increased a little over 2% annually or $10 million in five years. Yet, it grew by $100 million.

The public outrage at such fiscal profligacy has prompted the grassroots movement Stand Daytona to collect signatures for a Charter Amendment. The petitions must be signed by 20 percent of registered voters and recently the group announced that they already had over 80 percent of the required signatures.

For more information on these issues, read the Florida Tax Watch Local Taxation Report .

This is the rest of the post